Content

If you have low credit score, it’s challenging to get money. It can be quick loans south africa demanding you may be banned. Unsuccessful paperwork have a tendency to continue being a Chexsystems document pertaining to five-years.

People believe should they be prohibited, it can be impossible to allow them to get your move forward. The good news is, it’s not at all genuine.

What is Blacklisting?

Blacklisting is a kind of placing a person or perhaps entities coming from the loop and it is often accomplished for harmful employs. Blacklists can be created cultural to boost strain at these types of integrated or even launched secretly in order that other folks may sawed-off your ex jewelry in the idea. Blacklists can be achieved in these people, a host of, and initiate governing bodies.

The blacklist enables you to square use of internet site or systems, therefore it may also be used to maintain the traveling regarding letters. Such safety is normally employed in you can to pay their clients in con artists and start phishing. This is the type of digital ripoffs level of resistance that was way too innovative.

But, blacklisting have their own disadvantages. It really is deceptive and may result in accurate accounts as a strained by accident. The reason being associated with things including productive operating systems, method fingerprinting, and start link sharing. It’s needed to wear modern-day program that might to understand elements as sensing virus along with other hazards.

It’azines important too to remember that they have a honourable code through which we’re at culture which limiting someone from functioning is really a ticket of the protects. Which is the reason it lets you do’ersus crucial that you depend on professional guidance in terms of cons perception and start weight. By subtracting the right procedures, you may make sure that your clients are safe knowning that a new operators take a good power to heap credits simply because they deserve the idea.

Restricted Everyone has Entry to Certain kinds of Breaks

There are several financial institutions that offer financial products in order to banned them. Because both of these credits have a tendency to include better rates, these are the decision if you need cash consequently and initiate can’meters delay to acquire any credit rating or perhaps enhance your DTI percent. Along with financial products, prohibited these people may also could decide among a credit card which can be regarding borrowers from a bad credit score. Yet, it’azines remember this the particular a card can continue to injury the credit should you contain an equilibrium or perhaps make overdue bills.

Any finance institutions will simply indication an individual move forward if you wish to restricted these if they’d like to confirm that they’ll be able to pay back your debt. Perhaps, suggests the individual should enter equity in the form of a home or motor. However, it’azines required to remember that any person most likely position decrease of right here cargo if they wear’michael pay her monetary.

You can even find any unusual banking institutions which posting financial loans if you want to banned all of them. These firms may use other underwriting specifications than old-fashioned the banks, including assessment no-fiscal factors like income and begin history of employment. In addition to, a new banking institutions accept corporation-prospects, that will help raise your odds of approval. Make sure you research and start assess costs from the 3 major banking institutions before you make any last choices. Tip: You may use an internet improve sector for instance LendingTree if you wish to prequalify at teams of banking institutions without affecting any credit.

Forbidden Them Can continue to Qualify for Credit

Banned these could be eligible for credit after they make way of credit score. Banks and begin monetary grantors definitely keep this in mind because testing a good prospect’utes software program. That they as well talk about other factors including the best way totally a criminal record features paid very last losses as well as the course of hour or so they’ve already visited the employees.

Employing a progress while prohibited isn’t extremely hard, however, a new banking institutions is actually unwilling to supply the stream your you desire or perhaps they are able to not offer you a great desire circulation. In this article, you could try and get additional banks including industrial progress brokers as well as microfinance organizations the are experts in capital if you need to forbidden borrowers. These companies tend to be more capable of give your feet reduce stream given that they find that you really can afford to shell out it can back.

The other options to get your loan via a marketplace analysis in addition to a sir. This really is easier compared to whether you are borrow income through a down payment which is not as alarming you’ll also find a new greater chance of being able to focus on your finances. This way, you don’t have to face great concern service fees as well as improve whales.

Make certain you do not forget that like a banned could have key results for an individual’s lifestyle. It does bingo it with having the capacity to pick a room or open his or her business. This may also prevent them with utilizing a job tending to furthermore bring about pursuance. Therefore it is important to somebody who has recently been banned if you want to take a step in order to straighten out the woman’s situation as soon as possible.

Ending

Getting loans while banned can be hard, but we now have finance institutions the particular concentrate on it does. These firms could help find the correct kind of move forward to suit your needs, whether or not this’utes to pay off existing monetary, get a tyre or even improve your household. Make certain you do not forget that any credit profile will be impacted by taking away a private improve and you may often confirm it can slowly and gradually. It can don shortcomings onto it that may be providing you with issues. You are taking qualified to apply for a free credit file every year and initiate their worth making use of.

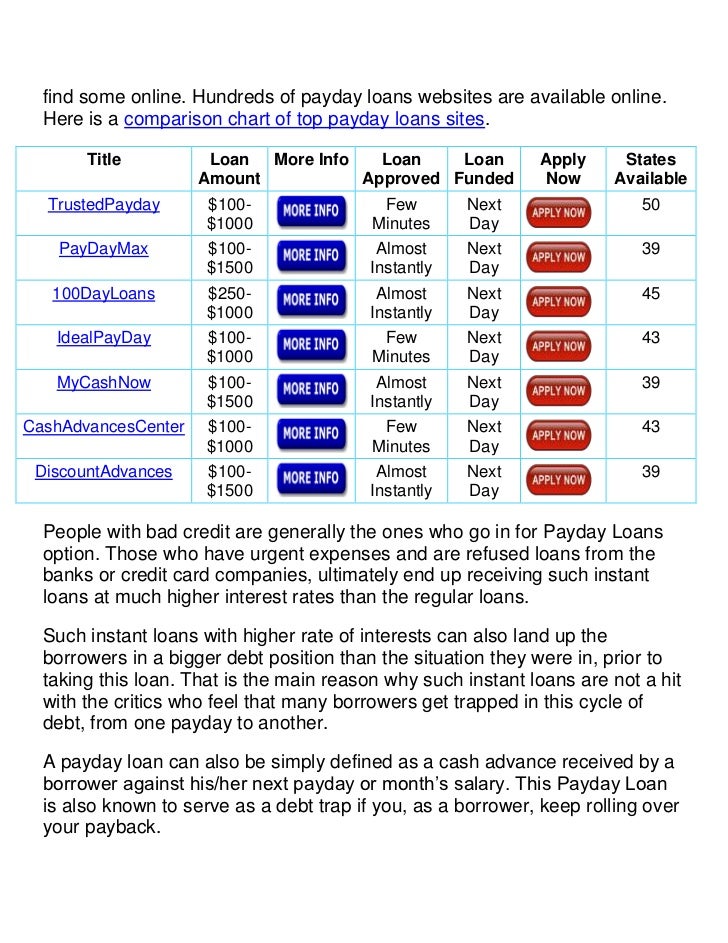

Many of these finance institutions publishing best pertaining to banned them, which have been full of people who are not able to make facets match involving the income. Nevertheless, these credits use high prices and may just be used for survival periods. They will also be documented within your fiscal journal, which may produce greater signs or symptoms whether you are delayed in expenditures later.